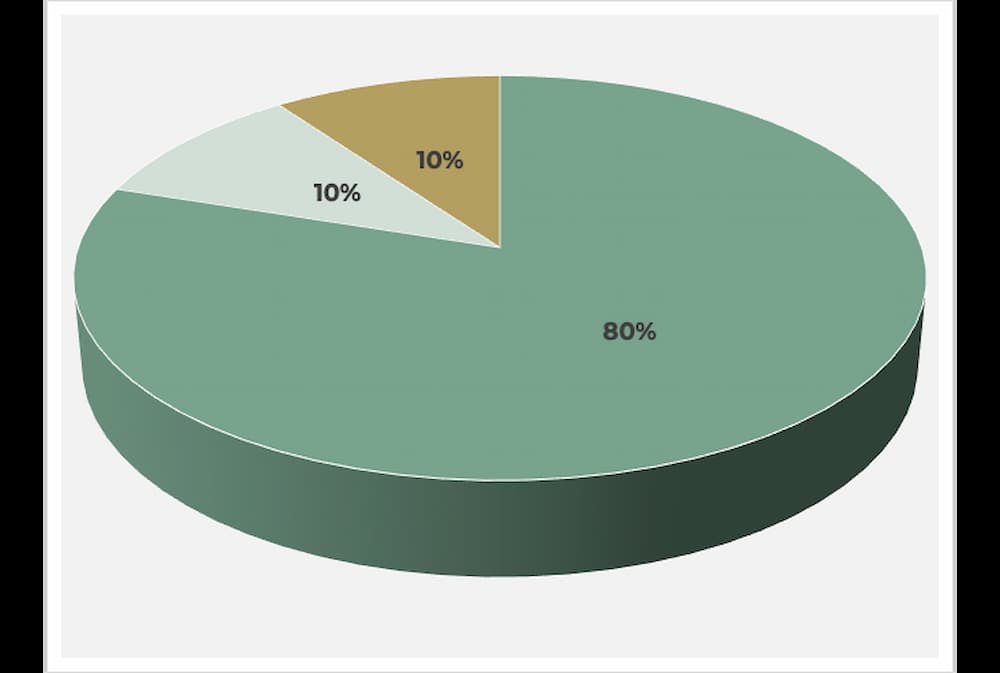

Pre-COVID-19, a merger and acquisition (M&A) deal that followed an 80/10/10 structure was fairly common. In such in a transaction, up to 80% of a company's purchase price would be afforded to the seller as an upfront, cash proceed, at least 10% of the company's purchase price would be in the form of rollover equity, and at least 10% of the company's purchase price would be in the form of deferred proceeds (e.g., an earn-out or seller note).

During COVID-19, capital providers (i.e., equity sponsors and lenders) are less keen to such a structure since COVID-19 has increased capital underwriting risks. As a result, capital providers are implementing more conservative approaches to structuring transactions. These often include less upfront cash to sellers at closing, increased rollover equity, and greater deferred payments.

As capital providers are more closely scrutinizing a company's 2020 financial performance via the findings of the quality of earnings and other financial due diligence activities, several common themes have arisen in the COVID-19 environment. They include the following:

- Increased cost of debt capital. Interest rates for acquisition debt have increased.

- Increased cost of equity capital. Secondary to any financial decline a company may have experience secondary to COVID-19, capital invested by equity sponsors may need to "work harder" to attain their desired return on investment.

- Decreased leveraged ratios. Both equity sponsors and lenders have a decreased appetite for over-leveraged transactions (i.e., including an excessive amount of debt in a transaction).

- Increased focus on net working capital. Both equity sponsors and lenders remain focused on a company's operating liquidity (i.e., Does a company have the liquidity necessary to continue to pay its bills and keep the lights on?).

- Downward pressure on EBITDA multiples. The realized and unrealized macroeconomic effects of COVID-19 have not only increased investment risk but also placed downward pressure on valuations.

Thinking Outside the M&A Box

To consummate a deal in the COVID-19 era, buyers and sellers should weigh pursuing creative solutions to reflect the investment risks that persist in the current environment. Here are a few options to consider that may help mitigate investment risk incurred by capital providers and push a deal over the finish line:

- Larger and longer earn-outs (i.e., getting a "second bite of the apple" later/less cash on closing)

- More seller equity rollover, as this sends a message to equity sponsors and lenders that the seller has meaningful "skin in the game"

- Seller-backed financing as a way of delaying capital gains and earning extra interest

COVID-19 M&A Quick Tips

If you are working through a deal during this health crisis, here are a few more points to keep in mind:Some buyers are issuing letters of intent that include valuations of companies that are more reflective with the higher, pre-COVID-19 purchase prices. Understand that when lenders consider the structure of their debt financing, they may be inclined to propose a different structure that reflects a lower quantum of debt or a lower debt-to-equity ratio than those seen before COVID-19. Cash at closing is only one piece of the total proceeds that sellers can receive from the sale of their company. Ideally, a deal should be structured that affords sellers a second bite of the apple in which the value of their rollover equity will be greater than the value of their cash proceeds that they receive at closing. Buyers and sellers should remain open-minded and maintain a willingness to be as inventive as necessary for structuring and completing a transaction.

Key takeaway: COVID-19 has forced healthcare businesses to navigate uncharted waters. Completing a transaction during these uncertain times will likely require buyers and sellers to take unconventional approaches.